Supply Chain Economics: How Generic Drug Distributors Achieve Efficiency Under Pressure

Generic drugs make up over 90% of all prescriptions filled in the U.S., yet they account for just 20% of total pharmaceutical spending. That’s the paradox: generic drug distribution is the backbone of affordable medicine, but its economics are built on razor-thin margins and fragile networks. When a single factory in India or China shuts down for regulatory reasons, hundreds of thousands of patients can go without life-saving medications. This isn’t a hypothetical risk-it’s happening right now. In 2023, 73% of generic drug shortages were linked to manufacturers operating at full capacity with no backup. Efficiency isn’t a luxury here. It’s survival.

Why Generic Drug Supply Chains Are Different

Most supply chains optimize for variety, speed, or customization. Generic drug distribution does none of that. It’s built for volume, cost, and consistency. There’s no room for innovation in packaging or branding. The product is identical across brands. So the only way to make money is to move more units, faster, with less waste. That means every step-from raw ingredient sourcing to last-mile delivery-has to be lean. But lean doesn’t mean brittle. The most efficient distributors today aren’t just cutting costs. They’re redesigning how they think about inventory, forecasting, and supplier relationships.Take the Economic Order Quantity (EOQ) model. It’s not fancy. It’s math: Q = √(2KD/G). K is ordering cost, D is annual demand, G is holding cost per unit. Simple. But in generic distribution, getting this right means the difference between a 30% stockout rate and a 98.5% service level. Leading distributors use this formula daily-not as a spreadsheet exercise, but as a live decision tool tied to real-time sales data. One distributor in Ohio cut inventory carrying costs by 28% in six months just by recalibrating EOQ based on weekly demand spikes, not yearly averages.

The Cost of Cutting Too Deep

For years, the industry chased the lowest possible price. Manufacturers cut staff. Distributors eliminated safety stock. Warehouses ran at 95% capacity. It worked-until it didn’t. In 2022, 80% of active pharmaceutical ingredients (APIs) came from just three countries: China, India, and Italy. When a single facility in Hyderabad failed an FDA inspection, 12 essential generics vanished from U.S. shelves overnight. No backups. No alternatives. Just silence.That’s why the industry’s average EBITA margin is stuck at 8%. Companies that cut too hard are now paying the price in lost sales, emergency air freight, and reputational damage. One mid-sized distributor in Pennsylvania lost $11 million in revenue in 2023 after a single shortage led to 47 hospitals switching to competitors. Their mistake? They’d eliminated all buffer inventory to save $1.2 million in storage costs. The math didn’t add up.

Efficiency Isn’t Just About Cost-It’s About Control

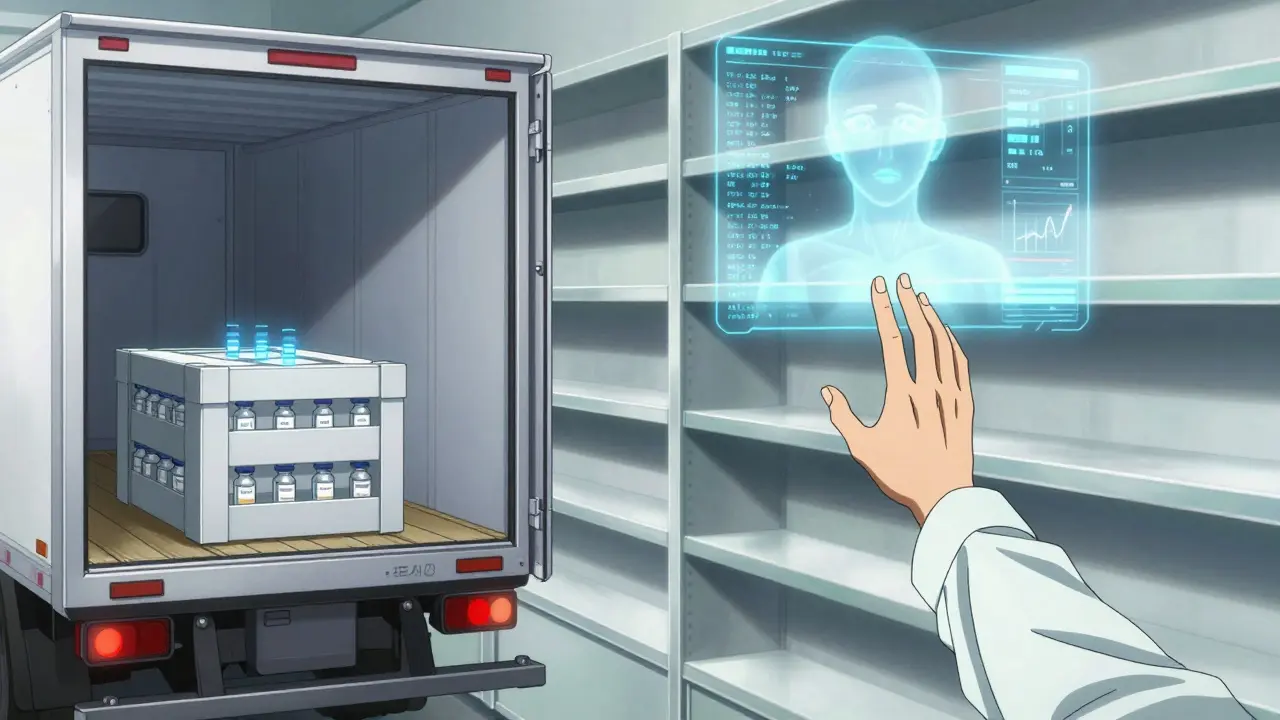

Top performers don’t measure success by how little they spend. They measure it by how much they control. That means three things: visibility, accuracy, and responsiveness.Visibility comes from cloud-based ERP systems that connect every warehouse, truck, and supplier in real time. IoT sensors track temperature, humidity, and shock levels during transit. Forty-five percent of generic drugs need climate control. One wrong temperature spike can ruin a batch. Companies like Cardinal Health now monitor every shipment from factory to pharmacy with live dashboards. If a truck hits 32°C for more than 20 minutes, the system auto-alerts a quality team-and reroutes the load.

Accuracy comes from AI forecasting. Traditional methods used past sales. That’s useless when a new Medicare policy suddenly increases demand for a $0.05 generic diabetes pill by 300%. AI models now pull in data from hospital admission trends, insurance formulary changes, even social media chatter about drug shortages. Teva Pharmaceutical’s AI system cut forecast errors by 39% in 18 months. That meant fewer overstocks, fewer shortages, and $28 million saved in inventory costs.

Responsiveness is about structure. The most efficient distributors use the Efficient Chain Model: standardized processes, long-term contracts with reliable suppliers, and minimal SKU variation. They don’t try to carry 10,000 drugs. They carry the 1,200 that make up 90% of volume. That focus lets them negotiate better prices, streamline logistics, and train staff to master a smaller set of SKUs. Their inventory turns over 12.7 times a year-compared to the industry average of 8.3.

Just-in-Time vs. Just-in-Case: The Real Trade-Off

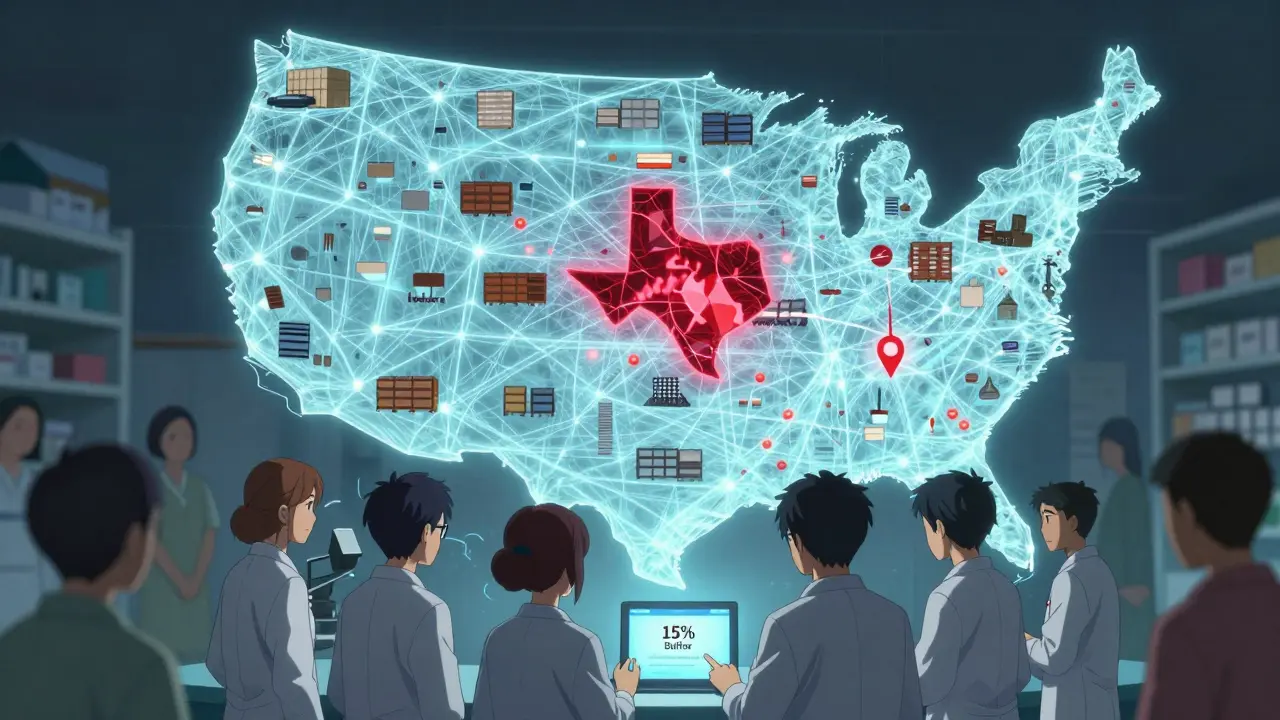

The debate between JIT and JIC isn’t theoretical. It’s financial. JIT reduces storage costs by 22-35%. Sounds perfect. But it increases stockout risk by 15-20%. JIC keeps buffers. That raises holding costs by 18-28%, but cuts stockouts by 40-60%.Top performers don’t pick one. They pick smart. For high-volume, stable drugs like metformin or lisinopril? JIT. For critical drugs with few manufacturers-like injectable epinephrine or insulin? JIC. One distributor in Texas maintains a 15% buffer for 14 essential generics. They call it their “life support inventory.” It costs $3.2 million to hold. But in 2023, it kept 12 hospitals running during a nationwide shortage. No one asked for a refund. They sent thank-you notes.

Technology Isn’t Optional-It’s the New Currency

You can’t compete with spreadsheets anymore. The leaders are using digital twins-virtual replicas of their entire supply chain. They simulate disruptions: What if the port of Los Angeles shuts down? What if a key supplier gets fined? What if demand for a generic antibiotic spikes after a flu outbreak? The model runs thousands of scenarios overnight. Then they act.McKesson’s new ‘DemandSignal’ platform reduced forecast errors by 37% in pilot tests. That’s not a minor win. It’s a game-changer. It means fewer emergency shipments. Fewer expired drugs. Fewer angry pharmacists. And it’s not just big players. Even smaller distributors are adopting modular cloud tools that cost less than $50,000 a year. Oracle SCM Cloud and SAP IBP are popular. But implementation is messy. One company spent 14 months and $2 million integrating legacy systems. They lost 6 months because their old warehouse software didn’t talk to the new AI tool. The fix? Start small. Fix forecasting first. Then add inventory. Then add transportation. Don’t boil the ocean.

Regulations Are Raising the Bar

The FDA’s Drug Supply Chain Security Act (DSCSA) requires full electronic traceability of every pill by 2023. The EU’s Falsified Medicines Directive does the same. That means every box, every pallet, every truckload must be digitally tracked from manufacturer to pharmacy. It’s not optional. It’s mandatory. And it’s expensive. Compliance adds 5-8% to operational costs. But here’s the twist: companies that embraced this early now have an advantage. Their systems are already built for transparency. They can prove authenticity. They can trace recalls in minutes, not days. That’s trust. And trust is worth more than margin.

Who’s Winning-and Who’s Falling Behind

The top 10% of generic distributors are pulling away. They’re growing market share by 12-15% a year. The bottom 25%? They’re shrinking at 3-5%. Why? Because efficiency isn’t just a tactic. It’s a culture. The winners have data-driven decision-making at every level. Their warehouse managers don’t wait for approval to reorder. They see the forecast. They act. Their procurement teams don’t chase the lowest bid. They chase the most reliable partner.Meanwhile, laggards still rely on fax machines, handwritten logs, and quarterly meetings to decide what to stock. One distributor in Ohio still uses a 1990s inventory system. Their staff manually enters sales data from paper receipts. Their forecast accuracy? 58%. Their stockout rate? 41%. They’re not just losing money. They’re losing credibility.

What You Can Do Today

You don’t need a $50 million budget to start. Start here:- Identify your top 20 drugs by volume. Track their demand patterns for 90 days. Are they stable? Spiky? Seasonal?

- Calculate EOQ for those 20. Use real numbers, not estimates. Adjust your reorder points.

- Implement a 15% buffer for any drug with only one or two manufacturers.

- Switch to a cloud-based inventory tool-even a basic one. Oracle, SAP, or even Zoho Inventory. Get visibility.

- Stop relying on historical sales. Start using monthly trend data. Even a simple Excel trendline beats guessing.

One pharmacy distributor in Iowa did this. In 9 months, they cut stockouts by 52%, reduced excess inventory by 27%, and increased their gross margin by 1.8 percentage points. No new hires. No new factories. Just better decisions.

The Future Is Integrated

By 2027, the most efficient distributors will run digital twins of their entire network. They’ll predict shortages before they happen. They’ll reroute shipments automatically. They’ll know which supplier to call when a storm hits a port. Their service levels will hit 99%. Their inventory costs will drop by half.But that future belongs only to those who act now. The ones waiting for a perfect solution will be left behind. In generic drug distribution, efficiency isn’t about being the cheapest. It’s about being the most reliable. And reliability? That’s what keeps patients alive.

Why are generic drug shortages so common?

Generic drug shortages happen because manufacturers operate with zero redundancy. With profit margins as low as 8%, companies cut costs by using only one factory per drug, often in just one country. When that factory shuts down-even for a routine inspection-there’s no backup. Over 80% of active pharmaceutical ingredients come from just three countries, making the system fragile. The more a drug is priced down, the less money there is to invest in safety buffers or alternative suppliers.

What’s the difference between JIT and JIC in generic distribution?

Just-in-Time (JIT) means ordering inventory only when needed. It cuts storage costs by 22-35% but raises stockout risk by 15-20%. Just-in-Case (JIC) means keeping extra stock as a buffer. It increases holding costs by 18-28% but cuts stockouts by 40-60%. Efficient distributors use JIT for high-volume, stable drugs and JIC for critical drugs with few suppliers. The key is knowing which is which.

How does AI improve generic drug forecasting?

Traditional forecasting used past sales data, which fails when demand suddenly spikes due to policy changes, outbreaks, or formulary shifts. AI models pull in real-time data: hospital admission rates, insurance coverage changes, even news about drug recalls. One distributor cut forecast errors by 39% using AI, which meant fewer overstocks, fewer shortages, and $28 million saved in inventory costs over 18 months.

Why is inventory turnover important in generic distribution?

Inventory turnover measures how often you sell and replace your stock in a year. Top distributors turn inventory 12.7 times annually. The industry average is 8.3. Higher turnover means less money tied up in unsold stock, lower risk of expiration, and better cash flow. It’s a direct indicator of operational efficiency. If your turnover is below 8, you’re likely holding too much slow-moving inventory.

Can small distributors compete with giants like McKesson?

Yes-but not by trying to outspend them. Small distributors can win by focusing on niche markets: rural pharmacies, specialty clinics, or specific drug categories. They can use affordable cloud tools to match the visibility of big players. One small distributor in Iowa used a $40,000/year cloud system to cut stockouts by 52% and grow its customer base by 22% in a year. Speed, reliability, and responsiveness matter more than scale.

What’s the biggest mistake distributors make?

Eliminating safety stock to save money. Sixty-eight percent of distributors who removed all buffer inventory reported severe shortages within a year. Generic drugs aren’t like sneakers or cereal. When a patient can’t get their blood pressure medication, they don’t wait. They go to the ER. That’s not just a supply chain problem-it’s a public health crisis. The cheapest solution is rarely the safest one.

Comments

Becky Baker

December 24, 2025 AT 19:01Why are we still letting China and India control our medicine supply? This isn’t efficiency-it’s national security failure. We used to make insulin here. Now we beg for it. Time to bring production home, no matter the cost. Our lives aren’t a supply chain spreadsheet.

Sumler Luu

December 24, 2025 AT 23:10I work in a rural pharmacy. When the metformin runs out, people don’t just wait. They stop taking it. Then they end up in the ER. This isn’t about margins-it’s about people showing up alive. The buffer stock? Worth every penny.

Sandeep Jain

December 25, 2025 AT 22:38in india, we make these drugs but no one here gets them affordably. funny how the system works. we export the life saving stuff, but our own folks pay 10x for same pills. its sad.

roger dalomba

December 27, 2025 AT 20:03Wow. A 39% reduction in forecast errors. Groundbreaking. Next up: AI will tell us when to breathe.

Amy Lesleighter (Wales)

December 28, 2025 AT 20:58efficiency isn't about saving money. its about not letting people die because someone cut a corner. we treat drugs like widgets. they're not. they're lifelines. stop counting pennies and start saving lives.

Rajni Jain

December 29, 2025 AT 10:53my cousin works in a warehouse in hyderabad. they work 12 hours, no breaks, and still get audited for 'noncompliance'. we blame the system but forget the people holding it together. maybe we should pay them more, not just the CEOs.

Erwin Asilom

December 29, 2025 AT 15:03The EOQ model, when applied dynamically with real-time demand signals, yields a 28% reduction in inventory carrying costs. This is not theoretical. It is operational excellence.

Nikki Brown

December 30, 2025 AT 18:32Of course you’re proud of your 15% buffer. But what about the patients who died waiting? 🙄 You’re not a hero. You’re just the last one standing before the collapse. And you still don’t get it.

Peter sullen

December 31, 2025 AT 09:01It is imperative, as a matter of strategic imperative and fiduciary responsibility, to implement a multi-tiered, cloud-integrated, AI-optimized, demand-sensing, ERP-anchored supply chain architecture-

-that leverages real-time IoT telemetry, blockchain-enabled traceability, and predictive analytics to achieve unprecedented service-level resilience.

Steven Destiny

December 31, 2025 AT 11:18Stop being timid. If we don’t nationalize generic drug manufacturing, we’re just letting foreign governments hold our health hostage. Build the factories. Fund the R&D. Do it now.

Fabio Raphael

January 2, 2026 AT 02:56I wonder how many of these 'efficiency gains' actually come from workers being pushed to their limits. Are we measuring productivity… or exploitation?

Natasha Sandra

January 3, 2026 AT 17:46So… we’re saying that if we just stop being cheap, people won’t die? 😍 I’m here for it. Let’s make medicine a human right, not a profit metric. 💖

sakshi nagpal

January 4, 2026 AT 04:19The global nature of pharmaceutical supply chains cannot be ignored. While local production is ideal, international collaboration with ethical standards may be the most pragmatic path forward. We must balance sovereignty with interdependence.

Brittany Fuhs

January 4, 2026 AT 21:19Of course the 'top 10%' are winning. They're the ones who didn't let 'globalization' steal our medicine industry. We should've banned imports 20 years ago. Now we're paying the price-with lives.

Sophia Daniels

January 5, 2026 AT 11:48Let me get this straight: we let a few factories in Asia make 80% of our life-saving pills… and we call this 'efficiency'? 🤡 This isn’t capitalism. It’s corporate Russian roulette-and we’re all holding the gun.