Generic Drug Prices Over Time: Year-by-Year Changes and What It Means for Your Pocket

Every year, millions of Americans rely on generic drugs to manage chronic conditions like high blood pressure, diabetes, and thyroid disorders. These medications are supposed to be cheaper, safer, and just as effective as their brand-name counterparts. But what you pay at the pharmacy counter doesn’t always match the story you hear about savings. Over the past decade, generic drug prices have followed a wild, unpredictable path-sometimes dropping sharply, other times skyrocketing with no warning. If you’ve seen your prescription cost jump from $4 to $45 in a year, you’re not alone. Here’s what’s really happening with generic drug prices, year by year.

How Generic Drugs Are Supposed to Work

When a brand-name drug’s patent expires, other companies can make the same medicine under its chemical name. That’s a generic. The FDA requires these generics to have the same active ingredient, dosage, and effectiveness as the original. But they don’t have to spend millions on marketing or clinical trials. That’s why they’re cheaper-usually 80% to 85% less than the brand.

That’s the theory. In practice, the price you pay depends on how many companies are making it. If five different manufacturers are selling the same generic, competition drives prices down. But if only one or two companies are left, they can raise prices with little pushback. The FDA found that when four or more companies make a generic drug, prices drop to about 15% of the original brand’s cost. With just one competitor, prices stay near 90%.

Price Drops: When Competition Kicks In

The biggest price drops happen right after a new generic enters the market. In 2018, the FDA reported that when multiple companies start making a generic, prices fall by 90% within the first year. That’s not a guess-it’s based on real data from manufacturer reports and wholesale invoices.

For example, when the first generic versions of the blood thinner apixaban (Eliquis) hit the market in 2020, the price per pill dropped from over $15 to under $2. By 2023, with five manufacturers competing, it was selling for less than $1. That’s the ideal scenario. The Congressional Budget Office estimates that between 2008 and 2017, generics saved the U.S. healthcare system $2.2 trillion. In 2017 alone, 843 new generic approvals saved an estimated $8.8 billion in one year.

These savings aren’t just numbers. They mean people can afford their meds. But here’s the catch: those big drops don’t happen for every drug. And once the initial wave of competition fades, things get messy.

The Volatility Problem: When Prices Spike

Not all generic drugs follow the same pattern. In fact, about 15% of them experience extreme price swings-jumps of more than 20% in a single year. Between 2013 and 2014, 8.2% of generic prescriptions saw price increases between 100% and 500%. One drug, nitrofurantoin macrocrystals (used for UTIs), jumped 1,272% between 2013 and 2018. Meanwhile, levothyroxine (for hypothyroidism) dropped 87% over the same period.

Why the chaos? It’s usually because of market concentration. A 2020 study in JAMA Internal Medicine found that 78% of price hikes over 100% happened in markets with three or fewer manufacturers. When one company exits the market-because of a quality issue, a factory shutdown, or financial trouble-the remaining ones raise prices fast.

Take lisinopril, a common blood pressure pill. In January 2022, you could buy it for $4 at Walmart. By December 2023, the same prescription cost $45. That’s a 247% increase. And it’s not an outlier. GoodRx data shows similar spikes for other generics like metformin, atorvastatin, and hydrochlorothiazide. These aren’t rare cases. They’re symptoms of a broken system.

Who’s Controlling the Market?

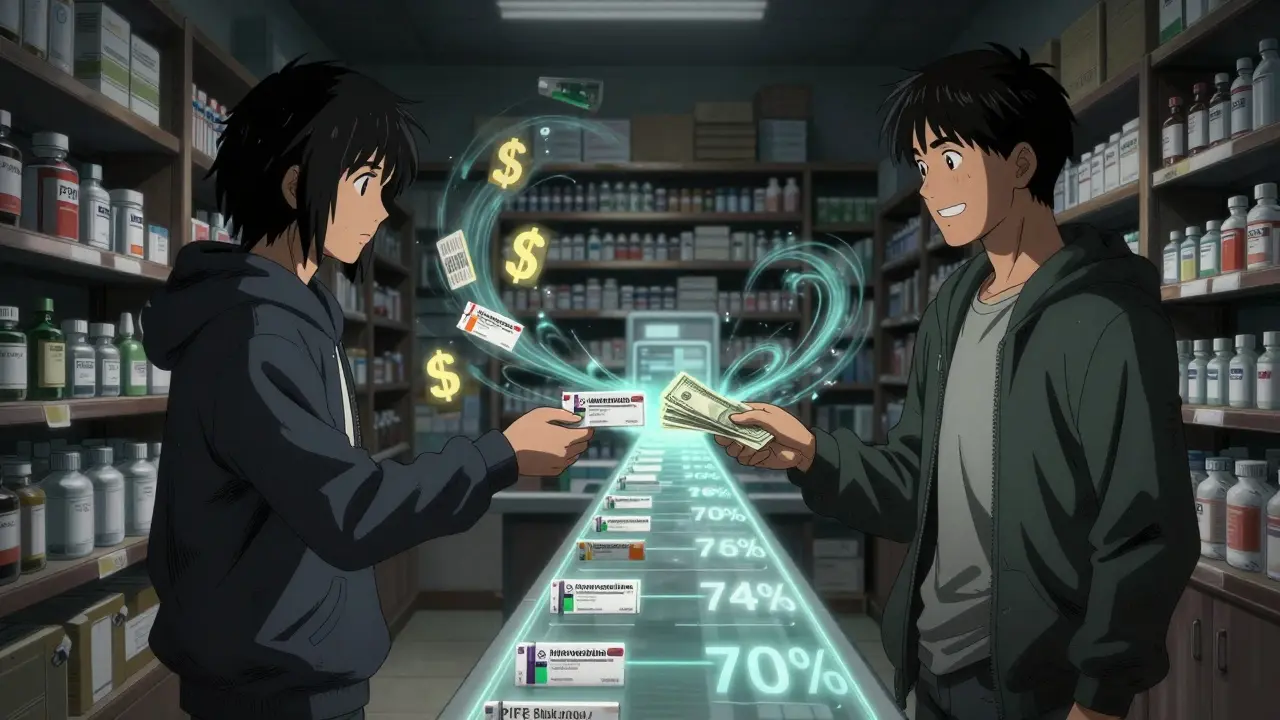

The generic drug industry used to be crowded. In 2013, there were about 150 companies making generics. By 2018, that number had dropped to 80. Today, the top 10 manufacturers control 70% of the market. The top five now hold 52% of sales-up from 38% in 2015.

This consolidation means fewer players, less competition, and more power to raise prices. The FTC has flagged this as a major concern. In 2023, their study found that 65% of price increases over 100% occurred in markets with three or fewer makers. That’s why they’ve launched 12 antitrust investigations into generic drug pricing as of mid-2024.

Manufacturers aren’t the only ones with leverage. Wholesalers and pharmacy benefit managers (PBMs) often negotiate secret rebates that don’t show up on your receipt. What you pay at the counter might be high, but the real cost to insurers is lower. That’s why pharmacies struggle: they’re stuck between rising wholesale prices and fixed reimbursement rates. One in four independent pharmacies reported losing money on certain generics because prices flipped overnight.

Supply Chain Cracks and FDA Delays

Behind the scenes, manufacturing issues are fueling price spikes. In 2023, the FDA found quality problems in 23% of foreign generic drug facilities. When a plant gets shut down for inspection, production halts. That’s what happened with generic metformin in 2020 and generic doxycycline in 2022. Within weeks, prices jumped 30% to 200%.

Even when drugs are approved, delays happen. The average time to launch a generic after patent expiration used to be 36 months. Now it’s 18 months thanks to faster FDA reviews. But that’s still long enough for brand-name companies to extend their monopoly through legal tricks or by tweaking the formula slightly.

And then there’s the Medicaid Best Price rule. It forces manufacturers to offer the same low price to every buyer, including Medicaid. That sounds fair-but it discourages companies from lowering prices for private insurers, because they’d have to match it everywhere. So they don’t lower prices at all.

What’s Changing in 2024 and Beyond

Some policy changes are starting to shift the landscape. The Inflation Reduction Act, which took effect in January 2024, removed the cap on Medicaid rebates for brand-name drugs. That led to 20+ brand-name drugs lowering prices that month. But for generics? Not much changed. The law doesn’t directly control their pricing.

The FDA’s 2024 Strategic Plan aims to speed up approvals for generics with few competitors-targeting 20% faster reviews. That’s a step in the right direction. The CMS also projects that by 2027, Medicare spending on generics will drop 8% because of better formulary controls.

But experts warn that 15% of generic drugs remain at high risk for price spikes due to manufacturing concentration. Cardiovascular and nervous system drugs are especially vulnerable. If you’re taking a generic for heart disease, depression, or epilepsy, your price could swing dramatically with little warning.

What You Can Do

You can’t control the market, but you can control how you pay. Here’s what works:

- Use GoodRx or SingleCare. These apps compare prices across pharmacies. On average, users save $112.50 per prescription on generics. In some cases, the cash price is lower than your insurance copay.

- Ask for a 90-day supply. Many pharmacies offer discounts for longer prescriptions. That can cut your monthly cost in half.

- Switch pharmacies. Big chains like Walmart and Costco often have $4 generic lists. Independent pharmacies may offer better deals if you ask.

- Call your doctor. If your generic price jumped, ask if there’s another one in the same class. Sometimes a different formulation or manufacturer costs less.

- Check for patient assistance programs. Some manufacturers offer free or low-cost meds to people with low income-even for generics.

Don’t skip doses because of cost. A 2024 KFF survey found that 37% of Medicare beneficiaries who take generics have skipped pills due to price. That’s dangerous. Talk to your pharmacist or doctor. There’s almost always a way to make it affordable.

The Big Picture

Generic drugs are still the best deal in American healthcare. They make up 90% of prescriptions but only 23% of drug spending. Without them, millions couldn’t afford treatment. But the system is fragile. When competition disappears, prices explode. When factories shut down, shortages follow. And when one company controls a market, patients pay the price.

Year-by-year, the trend isn’t simple. Some generics keep falling in price. Others keep rising. The key is knowing which ones are at risk-and having a plan to protect yourself.

Why do generic drug prices go up even though they’re supposed to be cheaper?

Generic drugs are cheaper because they don’t need to repeat expensive clinical trials. But their prices aren’t fixed. When only one or two companies make a drug, they can raise prices without competition. If a manufacturer shuts down or faces a supply issue, the remaining ones often increase prices quickly. This is especially common for older generics with low profit margins, where companies leave the market and then re-enter when prices rise.

Which generic drugs have had the biggest price increases?

Some of the most dramatic increases have been seen in nitrofurantoin (1,272% increase from 2013-2018), doxycycline, cyclosporine, and certain antibiotics like clindamycin. Blood pressure meds like lisinopril and hydrochlorothiazide have also seen sharp jumps-sometimes over 200% in 18 months. These are often older drugs with few manufacturers, low profit margins, and high demand.

Are generic drugs less effective than brand-name drugs?

No. The FDA requires generics to be bioequivalent to brand-name drugs, meaning they work the same way in the body. The only differences are in inactive ingredients (like fillers or dyes), which rarely affect how the drug works. Millions of people take generics safely every day. The issue isn’t effectiveness-it’s affordability and access.

Why do pharmacies sometimes charge more for generics than insurance covers?

Pharmacies are paid based on a formula called Average Wholesale Price (AWP), which is often inflated and doesn’t reflect what they actually pay. The real cost-called Actual Acquisition Cost (AAC)-is usually much lower. When the AAC rises faster than the AWP reimbursement rate, pharmacies lose money on the sale. To make up the difference, they may charge cash customers more, even for generics.

Can I switch to a different generic version of my drug?

Yes, if your doctor approves it. Many generics are interchangeable, even if they’re made by different companies. The FDA considers them therapeutically equivalent. But some people report differences in side effects or how they feel-often due to inactive ingredients. If you notice a change after switching, tell your doctor. They can help you find a version that works better for you.

Is there a way to predict which generics will spike in price?

You can’t predict with certainty, but you can look for warning signs. If a drug has only one or two manufacturers, has had recent shortages, or is an older medication with low profit margins, it’s at higher risk. Websites like GoodRx and the FDA’s Drug Shortages list can help you track these. If your drug is on that list, ask your pharmacist about alternatives before your refill runs out.

Comments

Jay Powers

January 11, 2026 AT 23:05I used to take lisinopril for years and never thought twice about it until my bill jumped from $4 to $45 overnight. I switched to Walmart’s $4 list and saved my sanity. People don’t realize how much power they have just by shopping around.

It’s not about politics it’s about knowing where to look.

Craig Wright

January 13, 2026 AT 03:35It is deeply concerning that the United States, a nation with unparalleled pharmaceutical innovation, allows such market distortions to persist without meaningful regulatory intervention. The absence of price controls in the generic sector represents a systemic failure of public policy. One must question the ethical foundations of a healthcare system where life-saving medications become unaffordable due to corporate consolidation.

Lelia Battle

January 14, 2026 AT 21:18It’s funny how we treat generic drugs like they’re disposable. We assume they’re cheap so they must be simple. But behind every pill is a factory, a supply chain, and someone trying to stay in business. When one plant shuts down, it doesn’t just affect profits-it affects whether someone gets their blood pressure med this month.

These aren’t just numbers. They’re lives.

Rinky Tandon

January 15, 2026 AT 15:43Let’s be real-the entire generic pharma ecosystem is a cartel disguised as competition. You think it’s about market forces? Nah. It’s about oligopolies playing chess with people’s health. The FTC is too slow. The FDA is too bureaucratic. And PBMs? They’re the real villains collecting kickbacks while you bleed cash at the counter.

It’s predatory capitalism wrapped in a white lab coat.

Ben Kono

January 15, 2026 AT 18:27My mom takes metformin and it went from $10 to $50 in a year. She skipped doses for two months. She’s 72. She didn’t tell anyone. I found out because her glucose monitor went nuts.

Stop pretending this is just a cost issue. It’s a moral crisis.

Konika Choudhury

January 17, 2026 AT 02:58India makes most of the world’s generics and still we blame American companies. The real problem is the FDA’s overregulation of foreign plants. They shut down a factory in Gujarat over a tiny contamination and suddenly nitrofurantoin doubles in price. Fix the system not the blame game.

Darryl Perry

January 18, 2026 AT 04:43Stop whining. If you can’t afford your meds, get a job. Or switch to a cheaper alternative. The market isn’t broken. You’re just bad at budgeting.

Windie Wilson

January 20, 2026 AT 02:09So let me get this straight. We have a system where a pill that costs 3 cents to make costs $45 because… nobody wanted to be the first to say ‘this is insane’? 🤡

And we wonder why people don’t trust medicine anymore.

Daniel Pate

January 20, 2026 AT 04:05There’s a deeper philosophical question here. If a drug’s chemical composition is identical to the brand-name version, why does its value fluctuate so wildly? Is value determined by scarcity, by human perception, or by corporate strategy? The FDA certifies efficacy, but the market decides worth. That disconnect is where the harm lives.

It’s not about pills. It’s about how we assign meaning to survival.

Jose Mecanico

January 21, 2026 AT 12:14GoodRx saved me last year when my atorvastatin jumped. I didn’t even know you could compare prices like that. Now I check every refill. It takes five minutes but saves me $80. Small effort, big difference.

Also-ask your pharmacist. They know more than you think.

Eileen Reilly

January 21, 2026 AT 22:13so like… the whole system is rigged?? like the pBms are getting paid under the table and pharmacies are losing money but we’re the ones getting charged?? 😭

and my dr just says ‘take it’ like its normal that i have to choose between meds and rent??

Monica Puglia

January 22, 2026 AT 15:00Just got my prescription refill today. Same drug. Same pharmacy. $45 last month. $12 today. 🤯

Turns out my pharmacist had a new shipment from a different distributor. I didn’t ask. I just paid and ran. But I’m telling you now-always ask. Always check. You’re not being annoying. You’re being smart. 💪💊