Medicare Part D: What It Covers, How It Works, and What You Need to Know

When you're on Medicare Part D, the federal program that helps pay for prescription drugs for people enrolled in Medicare. It's not automatic—you have to sign up separately, and if you wait too long, you could pay penalties for years. This isn’t just about getting your pills covered. It’s about controlling costs, avoiding gaps in care, and making sure you’re not overpaying for meds you need every day.

Most Medicare Part D, the federal program that helps pay for prescription drugs for people enrolled in Medicare. It's not automatic—you have to sign up separately, and if you wait too long, you could pay penalties for years. plans are run by private companies approved by Medicare. Each plan has its own list of covered drugs, called a drug formulary, a list of medications covered by a specific health plan. Some plans cover brand-name drugs better. Others save you money on generics. But if your medication isn’t on the list—or if it’s in a higher tier—you’ll pay more. And if you hit the coverage gap, known as the donut hole, you could suddenly be stuck paying 25% to 100% out of pocket until you hit the catastrophic threshold.

People often think all Part D plans are the same. They’re not. One plan might cover your diabetes meds cheaply but charge you $150 a month for your blood pressure pill. Another might have lower premiums but higher copays. You also need to watch for prior authorization, a requirement by insurers to approve certain medications before they’re covered. Some drugs, especially high-cost or high-risk ones, require your doctor to jump through hoops just to get you the script filled. That’s why an annual medication review with a pharmacist matters—many people don’t realize they’re paying more than they should, or taking meds that aren’t even covered.

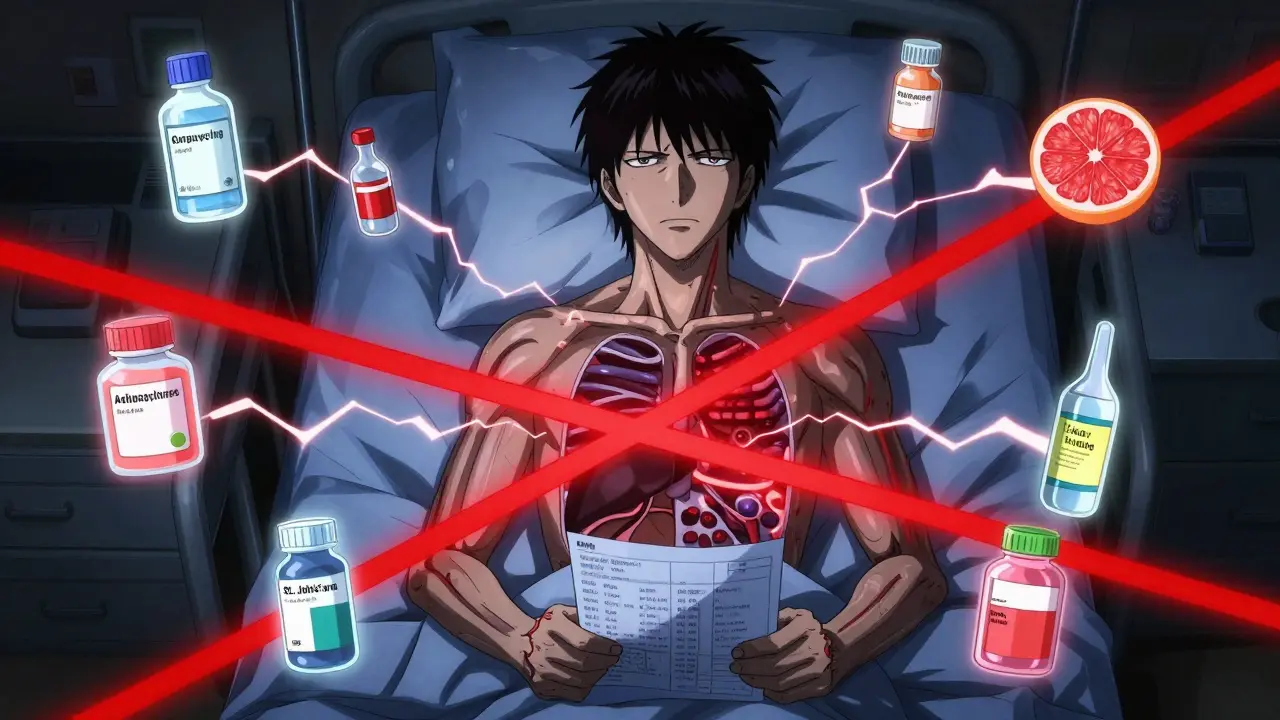

And it’s not just about the drugs. If you’re on multiple prescriptions—like a blood thinner, a thyroid med, or an antidepressant—you’re at risk for dangerous interactions. Some herbal supplements, natural products used for health purposes that can interfere with prescription drugs like St. John’s Wort or garlic can make your meds less effective—or worse, cause serious side effects. Medicare Part D doesn’t cover those, but they’re still part of your health picture.

What you’ll find here are real, practical guides on how to navigate this system. You’ll see how to check if your meds are covered, how to appeal a denial, how to compare plans without getting lost in fine print, and what to do if your insurance forces you to use a brand-name drug when a generic would work just as well. You’ll learn about NTI drugs, where tiny dosage changes can cause big problems, and why insurers sometimes block the cheaper option. You’ll also find tips on avoiding the donut hole, reducing out-of-pocket costs, and working with your pharmacist to cut down on unnecessary prescriptions.

This isn’t theory. These are the exact issues people face every day when trying to manage their meds under Medicare Part D. Whether you’re helping a parent, managing your own health, or just trying to understand the system before you turn 65, what follows will help you make smarter choices—without the jargon, the fluff, or the sales pitch.

Insurance Coverage of Generic Combinations vs Individual Generics: What You Pay and Why

Insurance plans often cover individual generic pills cheaper than combination generics - even when they contain the same drugs. Learn why this happens, how it affects your out-of-pocket costs, and what you can do to save money.

How to Use Tier Exceptions to Lower Your Medication Copays

Learn how to request a tier exception to lower your medication copays. Save hundreds a year by moving high-cost drugs to lower tiers with proper medical documentation.