Drug Formulary: What It Is, How It Affects Your Medications, and What You Need to Know

When your doctor prescribes a medicine, the first question your pharmacist might ask isn’t about dosage—it’s whether it’s on the drug formulary, a list of medications approved for coverage by your health plan. Also known as a preferred drug list, this list determines what you pay out of pocket, whether you need extra paperwork, and sometimes even if you get the medicine at all. It’s not a medical guideline—it’s a financial one. And it’s more powerful than you think.

Behind every drug formulary are decisions made by insurance companies and pharmacy benefit managers. They pick which drugs to cover based on cost, not always effectiveness. That’s why you might be told your brand-name pill isn’t covered, even if your doctor says it’s the best fit. Or why you’re forced to try a cheaper generic first—even if you’ve tried it before and it didn’t work. This is especially true for NTI drugs, medications with a narrow therapeutic index where tiny changes in dose can cause serious harm, like levothyroxine or phenytoin. Even small switches between generics can throw off your treatment. Yet insurers still push them unless you fight for a prior authorization.

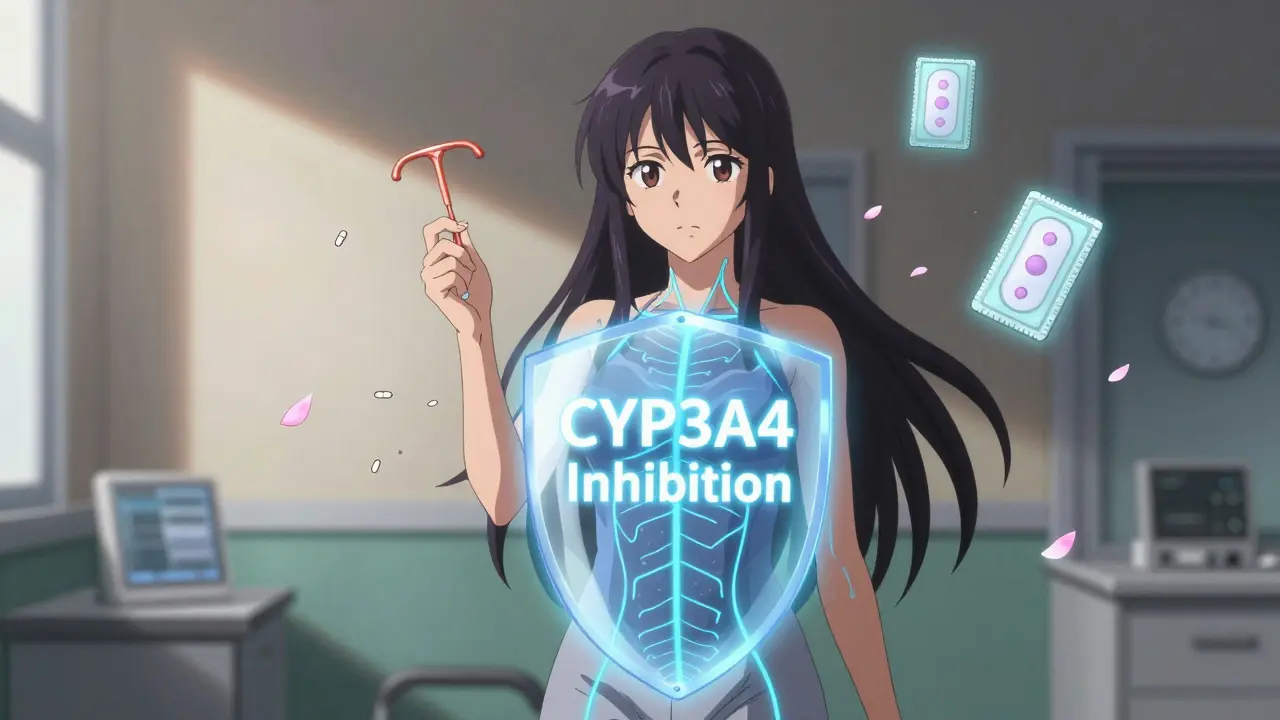

And it’s not just about brand vs. generic. The formulary also controls access to drugs that interact badly with others. If you’re on warfarin, your plan might block St. John’s Wort, an herbal supplement that can reduce the blood thinner’s effect and cause dangerous clots. Or if you’re taking colchicine for gout, they might flag it if you’re also on a macrolide antibiotic—because together, they can be deadly. These aren’t random restrictions. They’re based on real risks, but the way they’re applied often feels arbitrary.

Drug formularies change often. A medication might be covered one year and removed the next. Generic manufacturers can lose approval if their plants fail FDA inspections, which means even approved generics can suddenly vanish from the list. That’s why an annual medication review, a simple check-in with your pharmacist to go over every pill you take is one of the smartest moves you can make. It’s not just about avoiding side effects—it’s about catching when your formulary has changed and your medicine is no longer covered.

You’re not powerless here. You can appeal a denial. You can ask for a formulary exception. You can ask your doctor to write a letter explaining why a non-formulary drug is necessary. And you can always check the Drugs@FDA database, the official source for drug approvals, labels, and safety reviews to see if your medicine has been recalled or flagged for quality issues. Knowledge gives you leverage.

Below, you’ll find real-world examples of how drug formularies play out—whether it’s why your insurance won’t cover Vidalista Black, why Combivir is being phased out for HIV patients, or how herbal supplements sneak into dangerous interactions. These aren’t hypotheticals. These are stories people live every day. And the answers are in the details.

Prior Authorization Requirements for Medications Explained

Prior authorization is a common insurance requirement for certain medications. Learn how it works, why it's used, what to do if it's denied, and how to avoid delays in getting your prescription covered.